Interest Payments On U.S. Debt

That day may come sooner than you expect if the interest payments on the debt continue to balloon, which is likely:

Endgame: US Federal Debt Interest Payments About To Hit $1 Trillion

Soaring interest rates, driven by the panicked Fed’s scramble to undo its epic policy failure of 2020 and 2021 when the Fed kept rates at zero for far too long while injecting trillions into various asset bubbles, have been the key driver of the deficit, with the Federal Reserve boosting its benchmark rate by 5% since it began hiking in March last year. Five-year Treasury yields are now about 3.96%, versus 1.35% at the start of last year. As lower-yielding securities mature, the Treasury faces steady increases in the rates it pays on outstanding debt: that’s right – even when the Fed starts cutting rates, due to the delay of rolling over maturing debt, actual interest payments will keep rising for the foreseeable future.

For context, the weighted average interest for total outstanding debt at the end of June was only 2.76%, a level that’s not been surpassed since January 2012, according to the Treasury. That’s up from 1.80% a year before, the department’s data show, and if the Fed indeed keeps rates “higher for longer”, the blended rate on the debt will surpass 4% in one year.

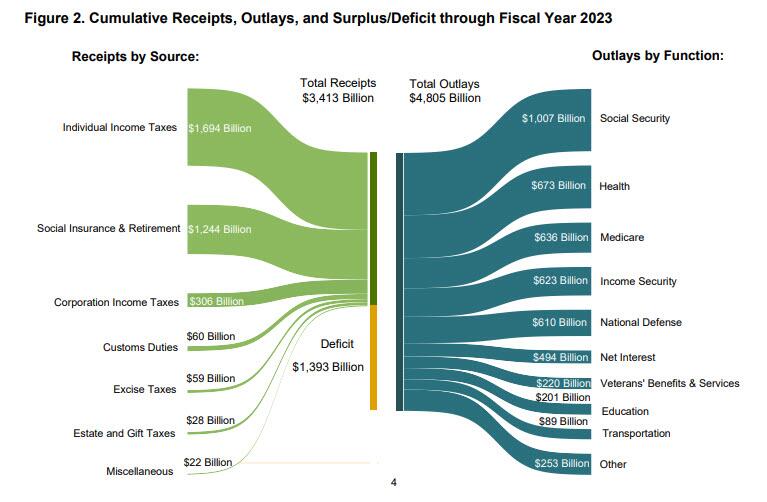

That would be a complete disaster for the US, and it would mean that interest payments on total US debt of $32.3 trillion would hit $1.3 trillion within 12 months, potentially making interest on the debt the single biggest US government expenditure and surpassing social security!

[…]

But we don’t even have to wait that long until the exploding interest on US government debt becomes a major talking point ahead of the coming presidential elections. According to the St Louis Fed’s FRED and the BEA, the interest payments by the Federal Government have now surpassed $900 billion for the first time ever, and within a quarter will hit probably rise above $1 trillion, a historic benchmark that will probably begin the countdown to the US Minsky Moment.

One of the most incompetent puppets in the Biden admin (and there are countless), Treasury Secretary Janet Yellen, has played down concerns about higher rates. She has instead flagged that the ratio of interest payments to GDP, after adjustment for inflation, remains historically low. The problem with Yellen’s argument is that GDP will crater after the next recession (which will also spark the next financial crisis, one which Yellen will not live to see), but US debt will never again drop in either absolute or relative terms, as the good folks at the CBO have been so kind to make clear to even such intellectual midgets as the former Fed chairwoman.

In short, the endgame has now arrived, and all the US can do now is rearrange the deck chairs .

This is wild. Completely unfathomable if we were in a sane society.

To put the above in simpler terms:

- Just interest payments on our debt amount to 1 trillion dollars a year.

- That is one trillion dollars a year, every year, just for debt management.

We don’t have a trillion to toss at interest. We’re already in the red:

It was bad enough at $500 billion. But to double that rapidly? With no end in sight? Insane.

And the debt itself is not forecasted to decrease at all. In fact, it is expected to grow quite astronomically. So nothing is actually getting paid off in the process of paying all of this interest.

Which also means that $1 trillion every year in interest payment would be the base cost, because debt is increasing, not decreasing.

This interest payment means the American people lose out on a trillion dollars a year. Every year.

Imagine where that money could go; how it could help our people. I remember just a few years ago how everyone whined about a few billion for a onetime-expense border fence. This is an annual trillion!

But no one complains. They just ship the money directly to the private bankers.

The most concerning part of this rapid rise in net interest is here:

$32.3 trillion would hit $1.3 trillion within 12 months, potentially making interest on the debt the single biggest US government expenditure and surpassing social security!

As an individual, if your largest expense is going to debt management (above food, housing, health, etc.), there is a pretty clear problem. How much more is this amplified for a country? What about a country as large, skilled, and resource abundant as the United States?

Our debt—and therefore debt interest—should be zero. Yet, it is rapidly approaching catastrophic levels.

One of the more ironic pieces of this puzzle is that the debt itself from which we derive the interest expense is created entirely out of nothing because of our credit-based monetary system. It’s all imaginary money.

I know that seems crazy, but that is literally what happened. They made money out of thin air, used it, and now we owe interest on the imaginary debt-money. The bankers then create more imaginary debt to pay off the previous imaginary debt.

It’s ludicrous, but it is what it is. Modern finance is ridiculous.

Our overall globalist system is of no help, either. One comment on the Zerohedge article nailed it:

End game? Does the author of this article actually understand how the USSA survives and exists in its current state? The USSA is 3.6% of the worlds population yet it consumes a smidgen over 24% of the worlds resources, when its economy is 78% service sector.

Dead on. We can’t afford anything, yet we consume everything we can get our hands on. This is not sustainable, especially once the debt hits a level which cannot be resolved. Couple this with BRICS and we have a storm brewing.

BRICS groups are fleeing the dollar and trying to establish a new reserve currency because they see the sheer insanity and unsustainability of our current fiscal situation. The only thing that is stopping the demise of the dollar right now, as far as I can tell, is the fact that if we drop, we drop 90% of the world with us. So BRICS are letting us print and use our play money, for the time being. But if they can establish an alternative, they can escape our fiscal crash once it all goes down.

But then the question is: will we let them create a viable alternative without a major international war? I find it unlikely. Whether that war is financial, biological, nuclear, or conventional is anyone’s guess.

We either face economic collapse or World War 3, and I’m not sure which to “root for” at this point.

One thing is for sure: You will live to see the day when the U.S. cannot pay its debt. It is my belief that this day is coming sooner than we think.

You can thank our debt-based monetary system and bankers for the fiscal reality we face, but thank our rulers for allowing it in the first place.

Read Next: The Bank Of North Dakota

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!