Our Monetary System: Based Completely On Debt

One of the fascinating things that made itself apparent with the student loan debt forgiveness program enacted by our Resident In Chief is the general masses lack of understanding about our monetary system.

A money system is not an economic system. The two types of systems are distinct from one another. The monetary system is the way a government provides money in a country’s economy. That’s our focus today.

We do not operate within a totally “free” market regarding money. We aren’t “capitalist” in terms of a monetary system. Instead, the best descriptor for our dollar system is by saying we reside under a debt-based monetary system.

There are three types of overarching monetary systems:

- Commodity money

- Commodity-backed money

- Fiat money

We are a type of fiat. A debt-based version of fiat, given how the money is “lent” out from the Federal Reserve.

What is interesting is that the debt-based version acts opposite of how you would expect a money system to act. For instance, if Americans pay down their debts, the supply of dollars shrinks. The supply goes “poof”. Because our system’s basis is in debt, when debt is subtracted, the total “dollars” goes down. It’s completely inverted to what you would traditionally assume.

What exactly is a debt-based monetary system? See here:

How the Debt-Based Money System Works (and doesn’t work)

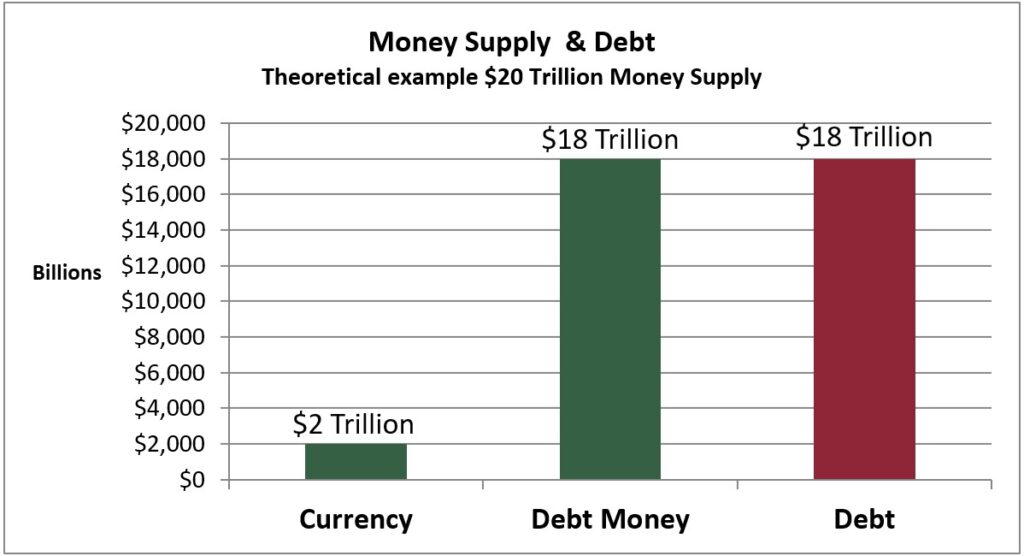

If we consider a 20 trillion dollar theoretical money supply in our existing system with 2 trillion dollars cash, we’d have this:

In this example, 18 trillion dollars in bank loans have been used to create 18 trillion dollars of bank-account money. That bank-account money is being used to pay salaries, buy groceries, pay rent etc., and as long as it’s used for goods and services, it keeps circulating in the economy and paying for many different things. However, all the borrowers whose loans have been used to create that money have made agreements to pay the money back, and as soon as they do that, the money is gone from the supply.

The bank account entries that all of us are using as money are money to us, but to the banks they’re liabilities. When the bank makes a loan it gets a promissory note from the borrower, which is essentially the borrower’s IOU promising to pay the money back to the bank. In exchange the bank creates the bank account entry that the borrower can use as money—this is the bank’s IOU. Thus when the money is paid back, the IOU’s on both sides are extinguished—money is no longer owed.

Whenever a borrower repays loan principal to a bank, that money disappears from the overall money supply. The money supply increases when banks make loans and decreases when borrowers pay principal back to the banks.

So if the economy is chugging along happily on a 20 trillion dollar money supply, all that has to happen to strangle it is for people to stop borrowing and start paying down debt, or for banks to stop lending. The supply of money is completely at the mercy of the bank lending system.

Plus all that debt has to be paid back to the banks with interest. What this amounts to is that home owners paying on their mortgages, graduates paying on their student loans, and all the other borrowers are essentially paying the banks to keep the economy supplied with money. The borrowers are saddled with constantly paying rent to the banks for the money supply that serves the whole economy.

You could stop right there and figure out that this is not the best way to create money for an economy, but there are additional problems.

The rest of their article is worthwhile for those truly interested in the subject, but you can get the information you need just from this snippet.

I also recommend their article on the “endless growth” theory.

What all this means is that Biden writing off these loans is actually a deflationary act. The added debt in our debt-based system vanished, so the total “money supply” decreased. Inflation is simply money supply and the velocity of money, so when the supply decreases, the general impact is deflationary. Nothing was printed to pay the loans off and no velocity changes were incurred. All the feds did was some accounting magic and voilà, less supply. Thus, less technical inflation.

Obviously, this is completely inverted to how we would traditionally view such an act.

You may wonder why I am bringing this up.

It is important for us dissidents to recognize the difference between what most view our system as compared to what we are actually under, a debt-based monetary system.

If we are trying to solve a problem within the economic realm, we have to take this into consideration. The economy does not operate how you would expect a commodity-backed monetary system to act, and that is what most people intrinsically think of when they review economic actions.

This information should also serve as a catalyst for the dissident to rally against a debt-based monetary system, because it is completely backwards. I personally prefer some form of a commodity-backed currency system over any fiat alternative, because it limits the bankers. But the debt-based fiat version is arguably the worst of any option.

Any system we create in the future must not use a system like this, because it is far too advantageous to the ruling class while providing nothing but negatives for average people like us.

Read Next: The Vanishing Of A Billion Dollars

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!