The Fed’s taking some drastic measures to contain the self-inflicted impact of the COVID pandemic. One of those methods is “unlimited” quantitative easing:

The Federal Reserve on Monday announced an all-out effort to support a U.S. economy stressed by the coronavirus pandemic by permitting unlimited buying of Treasury bonds and mortgage-backed securities.

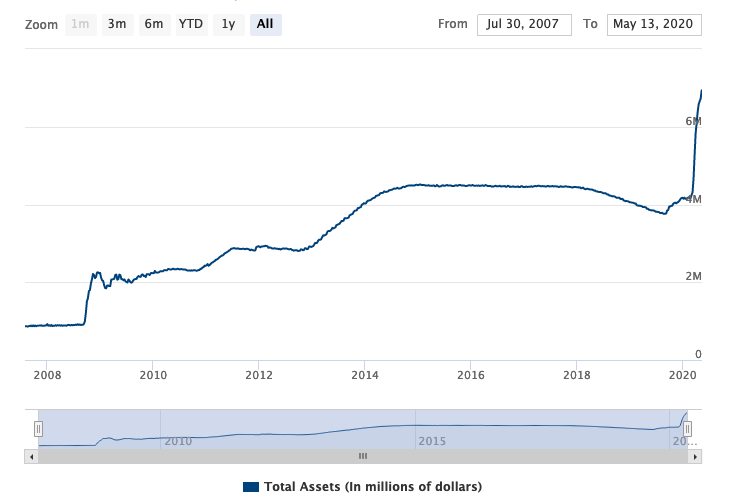

The quantitative easing represents the greatest-ever expansion of the Fed’s balance sheet.

“The Federal Reserve is committed to using its full range of tools to support households, businesses, and the U.S. economy overall in this challenging time,” the central bank said in a statement. “The coronavirus pandemic is causing tremendous hardship across the United States and around the world.”

Saying “aggressive efforts” must be taken to “limit the losses to jobs and incomes,” the Fed’s Open Market Committee set no limits in its new move to buy Treasury bonds and mortgage-backed securities.

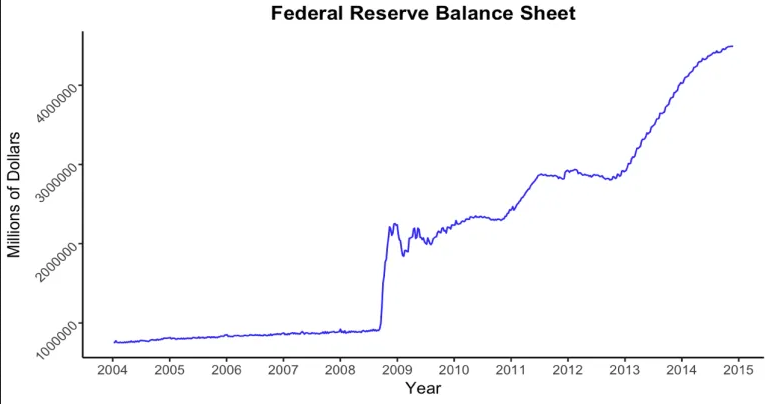

And buy assets it will. It’s not like they haven’t been doing this unsuccessfully for a decade already:

I’m surprised the central bank hasn’t just bought everything with the unlimited printer money.

Pretty horrible, isn’t it? Now compare it to more recent years:

The previous QE looks like child’s play compared to this round so far.

The Fed’s Unlimited Quantitative Easing

Before 2008 the monetary base increased at a stable, natural rate. You can see this in the first image from 2004 – mid 2008. Shortly after, the Fed’s quantitative easing policies shot that stability and predictability right out the window.

It’s goal was to give liquidity to banks so they would lend more and thus stimulate the economy. That failed miserably. Instead the banks kept most of it as excess reserves in case sh*t was going to get worse. Then the Fed failed to sell them off after.

They didn’t even hit their inflationary target. It failed completely.

The same thing will happen this time. The balance sheet will just keep growing with the free money from the Fed.

The initial idea behind it is ridiculous anyway. We’re in a pandemic. Even if banks have more liquid funds, it doesn’t mean more people have the capacity to produce more lending actions. The unemployment rate is at levels thought not possible – how will these people get loans? What person is trying to take out large scale loans right now?

The thought is that these loans would help keep many small-medium sized businesses alive through temporary loans. But you know what would also keep them alive? Letting them go back to work and actually earn money. Instead of potentially burning through loans that they would then need to be paid back with interest… on top of losing any savings from the inflation caused by QE.

Cash flow is a lot more essential to a business than an loan liability.

What we did was stab ourselves in the leg while starting an IV to pump more blood into us instead of covering and treating the wound itself.

We know instinctively that QE does not produce economic results; We have seen different central banks do it for decades at this point. Even trying to correlate the two is disingenuous. It’s not much different than praying everyday for something to happen and then attributing the prayer to when it eventually happens. And not attributing to the prayer when the exact opposite of the desired outcome occurs.

It’s also not uncommon for these excess liquidity sources to go to the worst possible place: foreign investment. Which is about as far from local business as possible. We print more money and then ship that same money overseas.

It takes time to recover from recessions; not liquidity to banks. Or you could just not shut down economies in the first place. Preventing the recession from occurring at its source.

Next up we’ll be trying negative interest rates I bet. Or printing everyone a million bucks for fun.

None of them have any idea what they are doing. It’s all a gamble to see what works. We’re pretty much in the middle of the biggest monetary test-run the world has ever attempted. You are the guinea pig.

Read Next:

Well, The Economy Tanked Again. Thanks Federal Reserve

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!