COVID-19 has been around for about 4 months (+- a couple months) now. It’s caused a total of 80k deaths worldwide as of this writing. It’s nearly summer and most people are assuming that it will wind down significantly due to seasonality.

It’s going to be a hilarious sh*tshow if the entire world shut down every economy over this small number of deaths. The economic ramifications of that action will kill far more.

Brazil refuses to shut down their economy and their deaths are pretty much the same as everywhere else.

I get it… don’t overburden the medical community. But in doing so: you’re overburdening literally every other community.

So now, congratulations! The economy tanked again. Only a little over a decade from the last time.

We can thank the shut down for part of it. We can also thank the $2 Trillion COVID-19 Package [That] Will Put Our Children Into Debt For Years To Come.

But beyond those: we can thank the Federal Reserve.

Thanks, Federal Reserve

Why?

Easy: their stupid handling of the inflation, money supply, and interest rates.

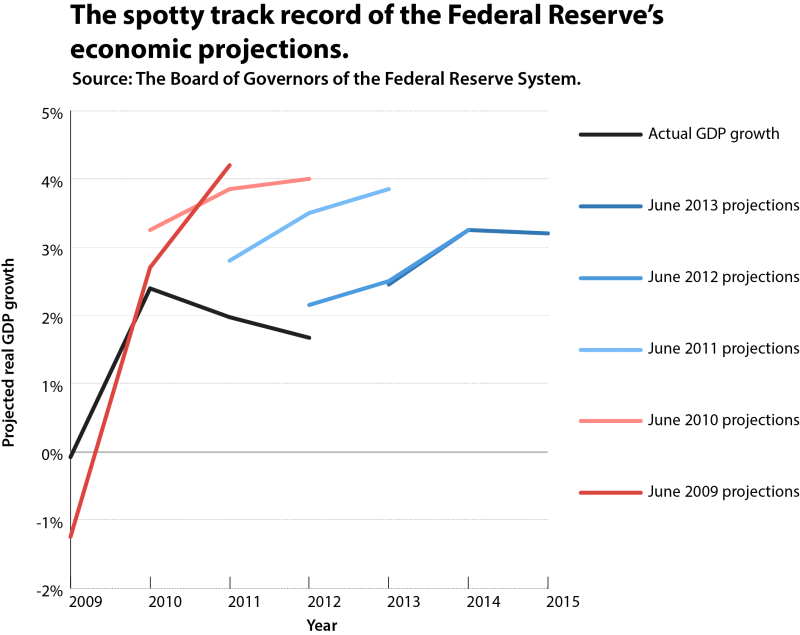

The Fed has a small army of PhD economists that know everything besides the everything part. They are notorious for failing at every estimation, even ones as soon as a month out:

Listen, I don’t know how much money we should have in our money supply nor do I know the appropriate price of money.

But neither do they.

And yet, they are the ones that decide just that.

When the currency is not tied to something stable, or at least non-regulated, these boom and bust cycles become so much worse.

End The Fed

The argument in favor of the Fed for the past decade has been that they are great at reducing the impact of dips and recessions. Well, the Fed lowered interest rates and responded to the market this time around and a resounding nothing happened. We still crashed. It didn’t even provide a blanket on the floor of the impact. So that argument is debunked.

The other argument in favor of the Fed is that they are price stabilizers: that gold is not a stable commodity. Which is true. Gold isn’t stable. But neither is fiat. Gold is more stable (and reliable) than constant inflation we get from the (privatized) Fed, however.

I’m not necessarily in favor of a gold standard. We could consider a basket of goods or some other means. However, I do know that no individual should be deciding on the amount and price of money when those same individuals can’t even figure out how to forecast a few months out. That’s a recipe for disaster. It led to the housing collapse and now it contributed to the corona-collapse.

I think Ron Paul said it best in End The Fed:

It’s as if we still believe that money can be grown on trees, and we don’t stop to realize that if it did grow on trees, it would take on the value of leaves in the fall, to be either mulched or bagged and put in a landfill. That is to say, it would be worthless. Why bright people in an advanced society can conclude that wealth can be increased by merely expanding the money supply is bewildering. I suspect that those who are the real promoters of central banking and fiat money are more motivated by power and greed than they are by sound economic theory. Many others are complacent and trusting and have probably not thought the issue through. I am convinced that I can get a twelve-year-old to understand the issue of money a lot easier than someone much older. Young people are more open to new ideas; older people are too often fixed in their ways. The total failure of the system we inherited in 1971 — confirming the theories of those who believe in sound money and who predicted this outcome — has awakened a whole generation of young people to the issue of money. They realize that the mess they are inheriting is huge and easily understand how it is related to fiat money and the Federal Reserve. In spite of the tragic consequences of Fed policy for the past several decades, there’s reason to believe, out of necessity if nothing else, that sound money will be given a serious hearing in the coming years.

Ludwig von Mises had it right many years ago when he predicted the downfall of all socialist economies, including the Soviet system, for a precise reason. Without a free market pricing system, there’s no way to make proper economic decisions regarding supply and demand of products and services. Free-market choices under socialism aren’t permitted; the government sets the price and plans production. Government bureaucrats can’t know what only markets can determine. Vital in the decision process is the profit-loss mechanism that rewards success and punishes failure. Government ownership of the means of production eliminates the benefits of bad decisions by business managers being punished. Under the socialism and interventionism that we have today, the successful are punished by being forced to bail out the unsuccessful. We don’t have socialism of our markets yet. When we do place wage and price controls on our economy, the market economy teeters or collapses, but generally in the past they have been removed and the economy recovers. Where we do have socialism is in money and credit and setting interest rates. This has been especially true since 1971 when the Bretton Woods Agreement ended and the dollar was delinked from gold.

By manipulating the supply of money and setting interest rates, the Fed has practiced backdoor economic planning. The Fed essentially keeps interest rates lower than they otherwise would be. In a free market, low rates would indicate adequate savings and signal the businessperson that it’s an opportune time to invest in capital projects. But the system the Fed operates discourages savings, and the credit created out of thin air serves as the signal for investors to spend, invest, and borrow excessively, compared to a system where interest rates are set by the market. This causes a major problem. A boom results, and overinvestment and excesses are built into the system, creating a bubble. A recession or depression doesn’t come for some extraneous reason; it is a predictable result of the excessive credit and artificially low interest rates orchestrated by the Federal Reserve.

There goes the economy. Make sure to do your part and thank your local Federal Reserve for their part in the corona-collapse.

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!