Economic Woes: The Suffering Index

Plenty of further bad news on the economic front as of late.

Both the Suffering Index and the Misery Index are at some of their highest in recent years.

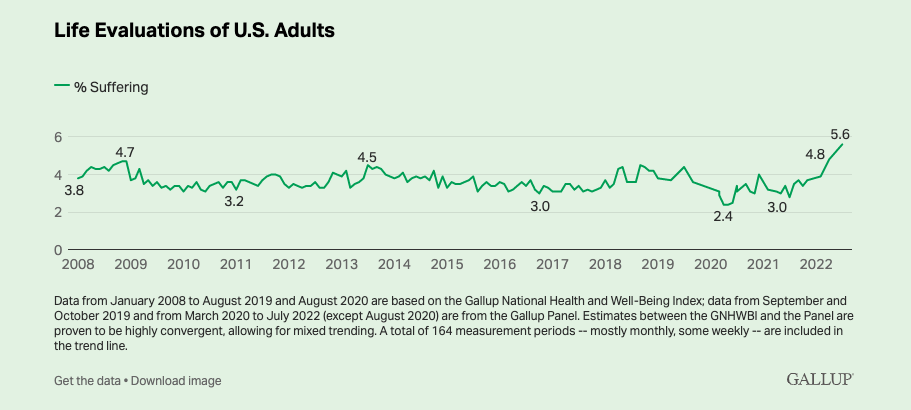

The Suffering Index, in particular, is at the highest level ever recorded.

The percentage of Americans who evaluate their lives poorly enough to be considered “suffering” on Gallup’s Life Evaluation Index was 5.6% in July, the highest since the index’s inception in 2008. This exceeds the previous high of 4.8% measured in April and is statistically higher than all prior estimates in the COVID-19 era. Across extensive measurement since January 2008, the suffering percentage has reached 4.5% or higher on a handful of occasions.

The most recent results, obtained July 26 to Aug. 2, 2022, are based on web surveys of 3,649 U.S. adults as a part of the Gallup Panel, a probability-based, non-opt-in panel of about 115,000 adults across all 50 states and the District of Columbia.

For its Life Evaluation Index, Gallup classifies Americans as “thriving,” “struggling” or “suffering,” according to how they rate their current and future lives on a ladder scale with steps numbered from 0 to 10, based on the Cantril Self-Anchoring Striving Scale. Those who rate both their current and future lives a 4 or lower are classified as suffering. Those who rate their current life a 7 or higher and their anticipated life in five years an 8 or higher are classified as thriving.

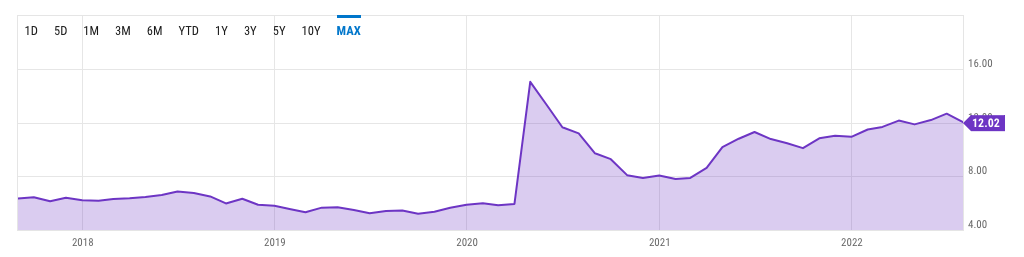

The Misery Index isn’t looking much better:

The US Misery Index is released by the Bureau of Labor Statistics. This metric is calculated by adding the US inflation rate and the US unemployment rate. The misery index can be used as a gauge at how the economy is doing. Because of the components, this indicator tends to be at its highest when inflation or unemployment has increased. For example, one of the most notable time periods in regards to high inflation was the 1980s. The US misery index went as high as 21.98 in 1980.

US Misery Index is at a current level of 12.02, down from 12.66 last month and up from 10.77 one year ago. This is a change of -5.02% from last month and 11.70% from one year ago.

It is no wonder so many people are suffering or miserable when you couple these two indexes with the other economic realities facing us.

We’ve also entered the technical definition of a recession (which remains true even if they are ignoring the conventional definition to avoid it). A recession is commonly defined as a fall of GDP in two successive quarters.

The GDP in the first quarter of 2022 was -1.6 percent. The Q2 GDP was -0.9%. [1]. We’re in a recession, and have been all year.

Even with this GDP fact, the massive inflation, the oddities with unemployment/labor market figures, stagnating wages, and many major indexes like the Suffering/Misery index, our “experts” still refuse to believe we’re in a recession—potentially tumbling toward a depression.

The recession deniers are always very wealthy, elitist people. They don’t see the grocery store prices like you or I. They probably use bougie apps like Instacart and don’t track their own credit card spending.

We have an incredibly weak economy, but the recession deniers can’t see it because it doesn’t affect them. The mainstream soyjack economists making $200,000 from the government in Fed money don’t care if the cost of meat goes up.

Whereas most regular Americans that aren’t complete authority bootlickers, which would probably include all of my readers, know that there is a recession. Because they’re getting hurt by it.

I’ve had to cut back on grocery spending rather significantly, personally. My family already doesn’t spend much, but we would be excessive on healthy foods and snacks. We’ve had to cut that back, especially as my pay has not gone up at all since inflation has started.

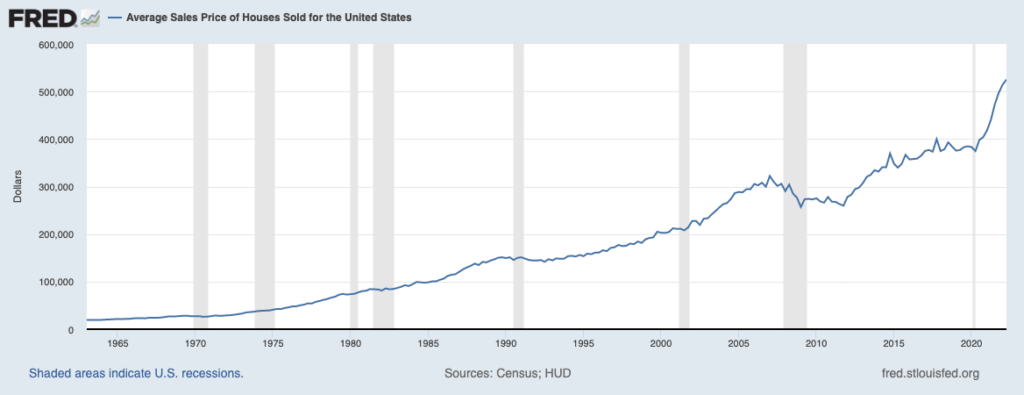

We had considered buying a house at some point. I don’t see that in the cards any time soon. Not with these interest rates and with the average sales price of a house being at its highest point ever ($525,000):

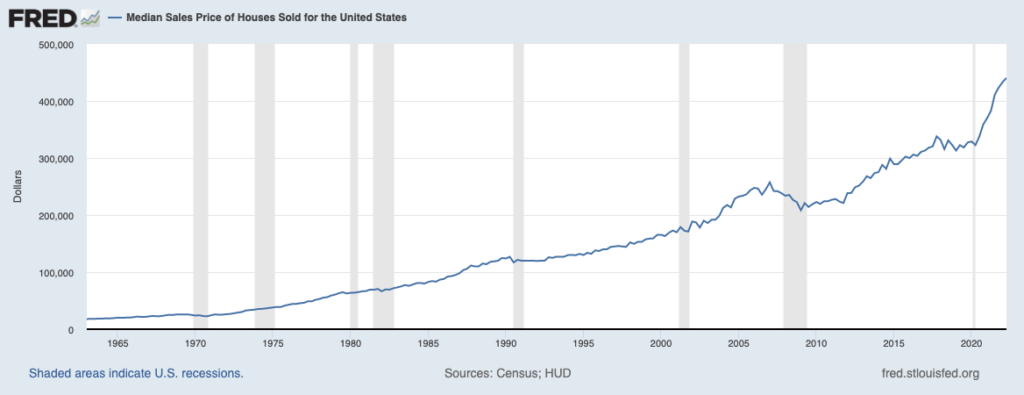

The median is not much better at $440,300:

Where I live, it’s even higher than the median. And income is lower than the median. My family simply can’t afford that. Not at these interest rates.

But rent has doubled, as well. There really is no escape.

Again, normal people can feel this pain. They can feel the suffering. The only people that don’t are the old folks who don’t pay attention to costs because they already have the essentials (like a paid off house) or the elites who don’t pay attention to costs because they are incredibly wealthy. Everyone else knows that we’re hurting.

But they still lie and say we’re not in a recession. It brings to mind the famous quote: “We know they are lying, they know they are lying, they know we know they are lying, we know they know we know they are lying, but they are still lying.”

It is maddening.

Still, there is cause for optimism. We are going through what very well may become one of the roughest times in American history if these trends continue. This is especially true if my fears regarding food inflation, the dollar crisis, and the fall of the petrodollar occur. Which means we will be the survivors; the ones that pull through. We must be.

I am thankful for all that I have now. Even if I lose all of it by tomorrow, I am still incredibly glad that I have what I have while I have it. My position could be much worse, and I will continue to work to help those who are in that worse position while I can.

Struggles aren’t made to be whined about or to defeat us. They are meant to be overcome. Fight for a better state, but do what you have to do to survive through the collapse of this one.

Read Next:

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!