Most Recent News

Popular News

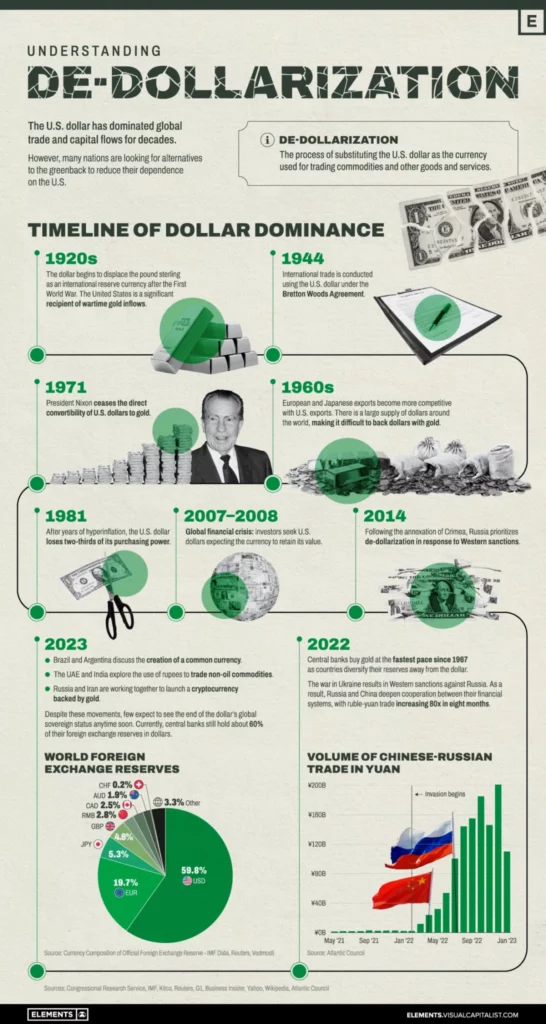

The weaponization of the dollar is rapidly leading to a crippled reserve status worldwide.

In The Fall Of The Petrodollar: Say Hello To Hyperinflation, I mentioned the impact if Saudi Arabia starts to accept other currencies for oil sales:

This could easily start a domino effect with other countries and exports that will remove the USD as the petrodollar and the reserve currency. If that happens, our “enjoyable” levels of 10% producer inflation (~8% consumer) will quickly turn hyper-inflationary.

It’s the single thing propping up our current spending and debt levels. If we lose that, it all starts crumbling.

Get ready to bring a wheelbarrow of cash to the grocery store to buy a single gallon of milk, circa early 1900s Germany style.

It is now official that the domino effect is underway. Dozens of major countries are now transferring payments to other currencies besides the U.S. dollar—Brazil, China, Saudi Arabia, Russia, UAE, India, and ASEAN nations, as of this writing.

This will have crippling effects for us. I know many are talking about the de-dollarization, but not to the level I feel it is owed. It is incredibly important because the only thing propping us up, the main domino, is our petro/reserve status.

And it is dwindling rapidly:

This is largely because of the weaponization of the dollar.

Crippling economic sanctions is how we bully other countries into compliance. But these other countries are moving to positions where they do not have to put up with us any longer.

But the reserve status does not just help us force others into compliance, it also:

And plenty of others.

These are only due to the USD being the reserve currency. This reserve status is only in place because oil is traded in the dollar, and all nations want to sell or buy oil. Reserve status does not have to do with the “stability” of the United States at all, especially if hostile countries do not want us to be stable.

With our current president pressuring Saudi Arabia and cutting off Russia, we just handed over the dollar-denominated oil sales, given time for them to transition. This is no longer a theory. It is currently happening, with major commodity nations now openly trading in other currencies. This reduces the dollar’s worth on the international stage, significantly.

An Economic World War is occurring, and we are sleep-walking into the battlefield.

Read Next: How To Fix The Housing Crisis: 3 Steps

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!

(Learn More About The Dominion Newsletter Here)